Navigating the Rhythms of the Market: Understanding Stock Market Holidays

Related Articles: Navigating the Rhythms of the Market: Understanding Stock Market Holidays

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Rhythms of the Market: Understanding Stock Market Holidays. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Rhythms of the Market: Understanding Stock Market Holidays

The stock market, a dynamic and complex ecosystem of financial transactions, operates within a structured framework that includes designated periods of closure. These periods, known as stock market holidays, are essential for ensuring the smooth functioning of the market and allowing participants to pause, reflect, and recharge.

While the market’s daily pulse is driven by the ebb and flow of buy and sell orders, these holidays serve as strategic pauses, offering a necessary respite from the relentless trading activity. Understanding the rationale behind these closures and their implications for market participants is crucial for informed decision-making.

The Rationale Behind Stock Market Holidays:

The rationale behind stock market holidays is multifaceted, encompassing factors that range from cultural observances to logistical considerations.

1. Observance of Cultural and National Events:

Many stock market holidays are rooted in the observance of significant cultural and national events. These holidays, often tied to religious festivals, national commemorations, or historical anniversaries, provide an opportunity for individuals and institutions to reflect on their shared heritage and values. By closing the market on these days, the financial sector demonstrates respect for these cultural traditions and allows participants to engage in these observances without the distraction of market activity.

2. Ensuring Operational Efficiency and Continuity:

Stock market holidays also serve a critical logistical purpose, ensuring the operational efficiency and continuity of the market. These closures allow for essential maintenance and upgrades to trading systems and infrastructure, ensuring a stable and reliable trading environment. By scheduling these maintenance periods during non-trading hours, the market can operate seamlessly without disruptions to trading activity.

3. Facilitating Employee Rest and Recuperation:

The importance of employee well-being is recognized in the scheduling of stock market holidays. By providing employees with time away from the demands of trading, these holidays promote rest and recuperation, fostering a more engaged and productive workforce. This, in turn, contributes to the overall efficiency and stability of the market.

4. Fostering Market Stability and Reducing Volatility:

Market holidays can also play a role in fostering stability and reducing volatility. By providing a break from the constant flow of trading activity, these periods can allow market participants to reassess their positions and make informed decisions, reducing the potential for impulsive trading that can contribute to market instability.

Understanding the Impact of Stock Market Holidays:

While stock market holidays are essential for the smooth functioning of the market, they also have implications for market participants.

1. Trading Restrictions and Market Closure:

During stock market holidays, trading is suspended. This means that investors cannot buy or sell securities on the designated day. This closure affects all types of trading, including equities, bonds, and derivatives.

2. Impact on Price Volatility:

The absence of trading during holidays can impact price volatility. While the market is closed, news events and global economic developments can still occur, influencing investor sentiment and potentially leading to price fluctuations upon the market’s reopening.

3. Limited Access to Information:

During holidays, access to real-time market information is limited. This can make it challenging for investors to stay informed about market developments and make informed trading decisions.

4. Potential for Market Gaps:

The closure of the market can lead to price gaps when trading resumes. These gaps occur when the opening price is significantly different from the closing price of the previous trading day, reflecting market movements that occurred during the holiday period.

5. Impact on Investment Strategies:

Stock market holidays can impact investment strategies, particularly for short-term traders who rely on frequent trading activity. These closures can disrupt their trading patterns and require adjustments to their strategies.

Navigating Stock Market Holidays: FAQs and Tips

Frequently Asked Questions (FAQs) about Stock Market Holidays:

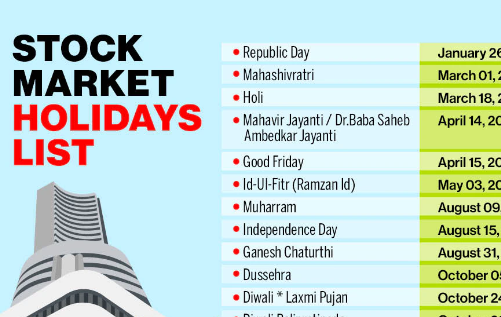

1. What are the major stock market holidays in a given year?

The major stock market holidays vary depending on the region and exchange. It is essential to consult the official calendar of the relevant exchange for a complete list of holidays.

2. How do stock market holidays affect my investment strategy?

Stock market holidays can disrupt short-term trading strategies. Long-term investors, however, may not be significantly impacted.

3. Can I still access my investment accounts during stock market holidays?

While trading is suspended, you can typically access your investment accounts and review your holdings. However, you may not be able to execute trades.

4. What happens to my orders placed before a stock market holiday?

Orders placed before a holiday may be executed on the next trading day, depending on the order type and the broker’s policy.

5. What are the implications of price gaps caused by stock market holidays?

Price gaps can create opportunities for traders but also pose risks, as prices can move rapidly upon the market’s reopening.

Tips for Navigating Stock Market Holidays:

1. Plan Ahead:

Review the stock market holiday calendar in advance and adjust your trading plans accordingly.

2. Stay Informed:

Even though trading is suspended, stay informed about market developments and global economic news that can influence market sentiment.

3. Avoid Impulsive Trading:

Resist the urge to make impulsive trading decisions based on limited information during holidays.

4. Seek Professional Advice:

Consult with a financial advisor for guidance on managing your investments during holidays.

5. Review Your Portfolio:

Use the holiday period to review your portfolio and make necessary adjustments to your investment strategy.

Conclusion:

Stock market holidays are an integral part of the financial landscape, serving a vital purpose in ensuring the smooth functioning and stability of the market. By providing a necessary pause from the relentless trading activity, these holidays allow for maintenance, cultural observances, and employee well-being. While they may disrupt short-term trading strategies, understanding their rationale and implications is crucial for informed decision-making and navigating the rhythms of the market. By planning ahead, staying informed, and seeking professional advice, investors can effectively manage their investments during these periods and capitalize on the opportunities they present.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Rhythms of the Market: Understanding Stock Market Holidays. We appreciate your attention to our article. See you in our next article!